Your policy number is one of the most vital pieces of information on your insurance card concerning your insurance policy. You’ve come to the right place if you’re wondering what the policy number on your insurance card is, what the policy number on your insurance card is, and what it represents. Everything you need to know about policy numbers, including what they are, where to obtain them, and why they matter, will be covered in this tutorial. We’ll also review how to use your policy number to access additional insurance services, change your information, or submit a claim.

In such a case, you’ll probably get a new insurance card. Insurance cards guarantee that you are charged the correct amount for service, contain crucial information, and serve as evidence of insurance. They assist your healthcare professionals in maintaining the accuracy of your insurance information. However, many consumers are unsure how to read an insurance card or where to locate specific crucial details. You may discover all you want to know about the typical components of an insurance card from this tutorial.

The majority find hustling with cards, numbers, and insurance a nuisance. That does not come as amazing, given those mathematical calculations and technical intricacies are hard to figure out. Say you are new to the insurance world and clueless regarding this domain’s crucial parameters and features. Continue reading to figure out what is the policy number on the insurance card.

The policy number lies at the top of your ID card or insurance document. Police officers and insurance operatives use this card to confirm your coverage. You should find this quickly if you get pulled over or in an accident. Keep reading the following guide to understand further details about the policy number on the insurance card.

Table of Contents

The membership ID is often the number of your health insurance policy. Your insurance policy will typically contain the member ID number. So it’s simple to locate. Your healthcare provider will use it to verify your coverage and eligibility. You may also provide your insurance company with the number so they can search for information if they have any inquiries about your policy or any recent claims.

Let’s say you have family members who rely on health coverage. In that situation, they could be given a unique policy valuable number for billing and identifying the person. Your coverage under your current or previous policies is determined by your health insurance policy number (HIPN). It’s essential since it supports employment, marriage, and divorce changes.

You must change your health insurance policy number to reflect your new situation. If you move out of your state, your HIPS should be changed to reflect your current location. Health insurance cards typically include simple information on who is insured and what insurance you are covered for.

Like the name, a policy number is like an identification number, aka ID, which is a coded way to reference you and the insurance policy you purchased.

It is pertinent to mention that usually, ID cards don’t list the full complexities of your coverage, such as the types or amounts. Your policy number generally lies at the top of your ID card or insurance document. It’s unique to you, and it demonstrates that you have coverage.

Moreover, every insurance has a different policy number. You will have unique policy numbers for your car insurance or home insurance. The policy number will even vary if you purchase all the insurance from the same insurer.

There is no need to learn or retain your policy number. Just keep your ID card in the vehicle as proof of insurance whenever you drive. Police can verify the number on the card to confirm you’re covered.

If you don’t have your card with you or, worse, you lose it, contact the insurance provider. They will help locate the missing ID number or re-issue an ID card.

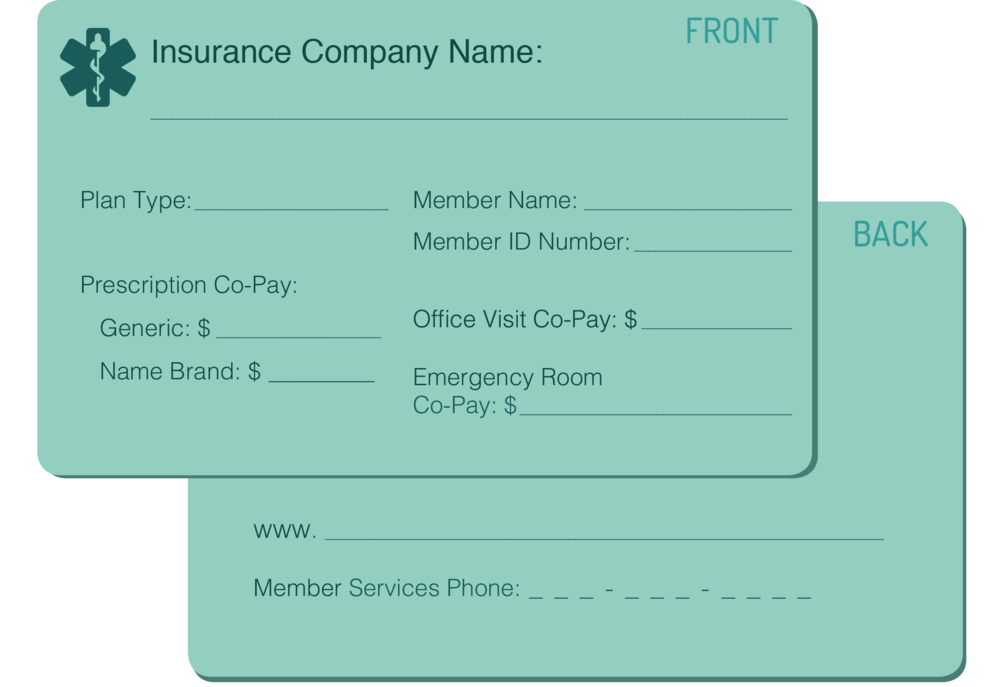

Reading an insurance card is simpler than you might imagine. It is also significant how your health insurance functions may be found on your insurance card. It can aid in your understanding of where to seek care and potential costs.

Out-of-network healthcare providers can still offer you care. For your care, however, you will need to pay them extra. The amount the insurance provider does not cover will be your responsibility. Suppose you are still determining whether your responsibility is to pay. If you are still deciding whether your provider is part of the network, contact your insurance carrier.

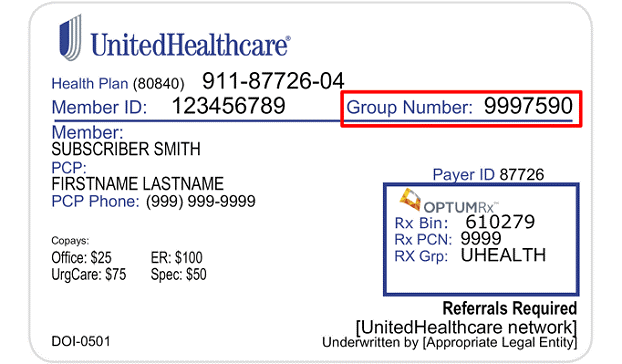

The group number on the insurance card identifies your employer plan, aka boss. The employer chooses a package for their employees based on price or type of coverage. This is determined through the group number.

If you have purchased your insurance through the health exchange, you wouldn’t have a group number. The group number is unique to the company or firm you are associated with and is present on your health insurance ID card. Everyone who has insurance through a company will have the same group number.

Subsequently, you can always verify coverage for yourself on your dependents by using the main member ID number found in your simply insured dashboard. Your group number and member ID will be on your physical Id card, available on your insured dashboard. Employers can identify the company’s group number on their monthly invoices.

Suppose you don’t find the group number on your insurance card; remember that it will usually show on your card’s front. If it isn’t there, you might need to phone the customer care line, although if you don’t get your insurance via your job, you might not have one.

Every provider’s insurance card looks different. The card lists a policy number, no matter who the provider is. Usually, policy numbers are between 8 and 10 digits; the placement of the policy number changes depending on which provider issued the card. Many car insurance cards list the policy number around the number will often be in the center of the card with the words “policy number” in front of it.

If you misplace your insurance card or policy number, you should avail the second one. Car insurance providers generally issue two insurance cards for every car insured under the policy. The best practice is to keep one card in your vehicle’s glove box and one in a safe place at home. You have a few options if you find yourself without an insurance card. If you call your provider, they can dispatch you new cards.

Official documents like an insurance card need to be carried frequently. Hence, you must have this card physically or digitally before getting behind the wheel. Insurance firms generally equip you with two cards for each vehicle on your policy. You may find it valuable to put a card in each respective car and have the vehicle’s primary driver keep the other in their wallet or a secure location at home. All of the vehicles covered by your coverage have the same policy number.

Many insurers also offer online help, making the process super fast and more suitable. Most providers can email you a printable company or allow You to use an app to access the card. You should be able to rapidly locate your policy number if the provider offers an official app. These digital insurance cards are now recognized as valid evidence of insurance in most states if you are pulled.

Next up, we will be discussing the member ID numbers. Almost all insurance plans will give, regardless of whether it is employer-based, you will receive a member ID number. Unlike the insurance group number on the card, which may apply to numerous people, this number is unique to you with the same employer as you and your dependents. The member ID number determines your coverage and eligibility for certain services.

Furthermore, your primary care physician, a healthcare practitioner, or other specialists may also utilize it for billing purposes and for your insurer to look into claims and benefits information. The policy number is specifically for your policy, but the group number usually refers to your employer or group where you’re getting your coverage. You aren’t receiving it through your employer if your insurance card has no group number.

Member ID number is unique and links to your specific health insurance benefits and coverage. In contrast, the group number is unique to your firm and is the same for all workers participating in the insurance plan.

A policy number on the insurance card for United Healthcare is an ID number coded to refer to you and your purchased car insurance policy. Usually, ID cards don’t list the natural complexities of your coverage, like the types or amounts. Your health plan will issue a member ID card to your insured family members when you enroll in health insurance. You can verify your health insurance by showing your member ID card.

To verify that your plan’s network covers them and to charge your health plan for your care, healthcare providers utilize the information from your member ID card. Some programs have mobile apps that allow you to share the member ID card on your smartphone or tablet. Keep your member ID card with you when you:

Every person protected by a health insurance plan has a particular ID number that permits healthcare providers and staff to verify coverage and arrange payment for services. It’s also the number of health insurers used to look up distinct members and answer questions about claims and benefits. The number is always on the front of the card. If you are the insurer, the last two digits in your number might be 00, while others on the policy might have numbers ending with numeric characters like 01,02, etc.

Each employer that buys a health plan for its employees also has a number. These group numbers identify the specific benefits associated with your employer’s plan. Healthcare providers use the group and member ID numbers to file claims for your protection. You could not have a group number if you purchased insurance through a healthcare exchange.

You can call your insurer’s customer service number and know your policy number. All you need to do is provide the requested details to the customer executive, and they will tell you your policy number. You can also see the customer care contact number on the insurer’s website.

Because you may need prior authorization for some benefits or information about what services and providers are in the network, you should contact your insurance to help understand your benefits. Most healthcare services and insurance providers have staff members to help you find the necessary information.

You receive an updated health insurance card regularly, depending on your insurance type. This card has important information that will:

Your health insurance policy number is your member ID. This means it should be found on any cards you have when joining. It can also be helpful if there are problems verifying coverage or eligibility because this helps verify who we are talking about.

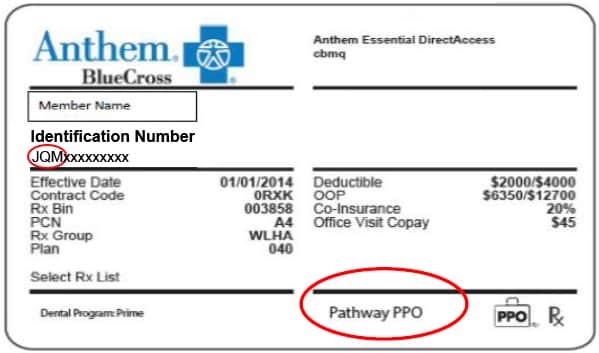

There are many various types of health insurance plans. Insurance companies list the kind of plan on your ID card to help healthcare providers file claims correctly. For some plan types, the plan type will be listed on the ID card (for example, HMO), while Medicaid and Child Health Plus cards will feature each program’s respective logo. Each plan type has different ways of handling referrals, in- and out-of-network providers, and out-of-pocket costs. The most common types are:

Some insurance companies give specific names to certain plans, like those available through the healthcare exchange, instead of using group numbers (above).

Many health insurance cards show the amount you will pay (out-of-pocket costs) for typical visits to your primary care physician (PCP), specialists, urgent care, and the emergency department. This may be a flat rate (copay) or a percentage of the cost (coinsurance). If you see two numbers, the first is your price when you see an in-network supplier, and the second—usually higher—is when you see an out-of-network (OON) provider. For example, when you’re referred to an expert or sent to a different hospital, they may not be in your insurer’s network.

Your insurance company may provide out-of-area coverage through a different healthcare provider network. If so, the name of that network will likely be on your insurance card. This is the network you’ll want to search out if you need entry to healthcare while you’re away on vacation or out of town on a business trip.

All the necessary information for utilizing your health insurance is on your Anthem Blue Cross Blue Shield insurance card. We will mail you an Anthem ID card if you enroll in an Anthem plan as a Medicare member. If you or your business have already chosen to use digital ID cards, we won’t issue you an ID card for other sorts of members.

Your Anthem insurance card must be kept in your wallet or handbag. You may retrieve your Anthem policy number using your mobile or desktop if you have a digital Anthem ID card. You can use it to pay for benefits or treatment or when you go to the doctor.

You may access your health information using the My Health Records feature in the Anthem Sydney app. Call 800-676-BLUE (2583) to get a new Anthem ID card, or you may print one online.

At last, life insurance provides several valuable benefits, including:

The group number on the Medicaid card identifies your employer plan. Each employer chooses a package for their employees based on price or type of coverage. This is determined through a group number. The health insurance group number is assigned to the employer that bought your plan. It pinpoints the exact benefits that your program provides. It is a different number than your member ID card; your medical provider uses it for billing purposes.

Your insurance card’s group number identifies the employer that purchased your health insurance plan. It usually only appears on insurance cards given to you by your employer. So if you bought your insurance through the Healthcare Marketplace or have a government-based plan such as Medicare, you may not see a group number on your insurance card. Your medical supplier will use this for billing and plan identification pursuits in addition to your member ID number.

An insurance card is proof of your purchased insurance. If it is a health insurance card, you can use it when visiting the doctor, hospital, or another provider. It is also a brief mention of how much you must pay. Knowledge of your card can support you in planning your healthcare expenditures and getting the necessary care.

An insurance card is a card whereby a Senate or family member may be privileged to get appropriate treatment from a hospital. It is provided by an agreement with an insurance company regarding section 2A to reimburse the expenditure incurred on such medical treatment. Insurance companies include any company involved in life insurance or health insurance.

A health card is identity proof in health insurance that holds your details, policy information, and financial coverage under a health insurance plan. It offers cashless payment options for medical bills from hospitalization and other treatment charges. When you present your health insurance card to the hospital management, you will digitally analyze the financial coverage you can avail yourself of to plan for the treatment. They can also get the expenses reimbursed by the insurance provider directly.

You can buy health insurance online and conveniently dispatch the insurance card to your address. The information relating to your health insurance is further explained by the facts shown on the health card. It stores your name, policy number, health insurance policy type, covered amount, expiration date, etc.

Although many of us don’t frequently require our insurance cards, having them on hand is essential when the time comes. You’ll need quick access to your insurance documentation if you are ended with a traffic infraction. The way drivers prove they are insured is with an insurance card. Each insurance card features a policy number unique to your insurance account. After a car accident or if you get dragged over by the police, you’ll need proof of insurance with you in the car.

Car insurance providers generally issue two insurance cards for every vehicle insured under the policy. The best practice is to keep one card in your vehicle’s glove box and one in a safe place at home. You have a limited choice if you find yourself without an insurance card.

If you call your provider, they can mail you new cards. Many insurers also offer online resources, which makes the process much faster. Most providers let you view the card through an app or email a printable version.

You should be able to rapidly locate your policy number if the provider offers an official app. In most places, these digital insurance cards are now recognized as evidence of insurance if you are stopped.

When involved in a collision, it’s crucial to exchange insurance information promptly. A good practice is to offer your insurance details first as a gesture of goodwill. Accidents can leave people shaken, making it challenging to jot down all the necessary information. Utilizing your smartphone to snap a picture of the other driver’s insurance card can streamline the process, ensuring you have everything you need to file a claim.

If uncertainty looms regarding who’s at fault, contacting the police immediately after the collision is advisable. They can compile a report, which could prove beneficial if obtaining the other driver’s insurance details proves difficult. The police report typically contains the personal and insurance information of the other driver, allowing you to retrieve their policy number for the claim.

Storing your insurance card in your glove box is recommended. Moreover, in many states, utilizing an app to generate a digital insurance card for proof of coverage is an option.

Upon signing up for a policy, your provider issues a vehicle insurance card, complete with a policy number. Typically, two cards per vehicle are issued. It’s wise to keep one at home and one in your car as a backup.

The policy number is typically located on the insurance card the insurer provides. If you cannot find your insurance card, you may be capable of finding your policy amount by logging into your insurer’s website or contacting customer service.

A policy ID is a number that uniquely identifies a given insurance policy. Insurance companies typically use it to keep track of their customers’ policies, and it can be helpful for customers when they need to reference their policy information. The policy ID may also be known as a policy or an insurance policy number.

When policies are formed, insurance firms issue them a policy number. The first policy that the firm creates will have a policy number. The first policy that the firm makes will have a policy number that ends in “001,” and the second policy will have a policy number that ends in “002.” and so on since policy numbers are often assigned in consecutive order. The assignment of policy numbers, however, may also be done by certain insurance firms using algorithms or random number generators.

Important information regarding your insurance coverage may be found in your policy number. Usually, it contains the following information:

Your name, the name of your insurance agency, and the day your coverage kinks in are generally in the middle of a health insurance card, along with your policy number. It could be called an “ID Number” or a “Policy Number.”

You must supply your policy number whenever you need to view your insurance policy or submit a claim. You need your policy number for the following reasons:

When you secure insurance from an insurer, they assign you a unique policy number, prominently displayed on your ID card. This number serves as proof of your coverage and is essential to have on hand for any insurance-related needs. It’s advisable to keep your insurance policy card accessible, perhaps in your dashboard, for quick reference. Your insurance policy number acts as a distinct identifier, linking your car insurance policy directly to you. Before committing to any insurance policy, take the time to thoroughly review its terms and conditions.